Booming Global PET Market: Key Industry News You Can't Miss

Expansion Opportunities in the PET Bottle Market

PET plastic bottles are increasingly favored for their unique features—tamper-evident seals, ergonomic designs, and specialized caps—that enhance both consumer experience and product value.

The PET plastic bottle market is experiencing significant growth, driven by rapid urbanization and changing lifestyles in developing countries. Major markets like China, Japan, and India are key contributors, particularly in sectors such as beverages, food, pharmaceuticals, and specialty drinks.

Market Segmentation

1. Bottle Capacity: Bottles ranging from 500ml to 1000ml dominate the market. These sizes are widely used in beverages and household products, catering to consumer demand for convenience and versatility.

2. Neck Type: PCO/BPF neck-type bottles lead the market. Their standardized design and compatibility with a variety of caps offer greater flexibility and convenience for manufacturers and consumers alike.

3. Industry Applications: The beverage industry is the largest consumer of PET bottles, driving ongoing demand for lightweight, efficient, and eco-friendly packaging solutions.

As environmental awareness and regulations tighten, demand for recyclable and biodegradable PET bottles is rising. Manufacturers are investing in lightweight bottles and innovative solutions, such as integrated bottle caps, to boost recycling. In the EU, new rules require bottle caps to remain attached to bottles to reduce pollution and improve recycling. However, this design has received some criticism due to its potential impact on user experience.

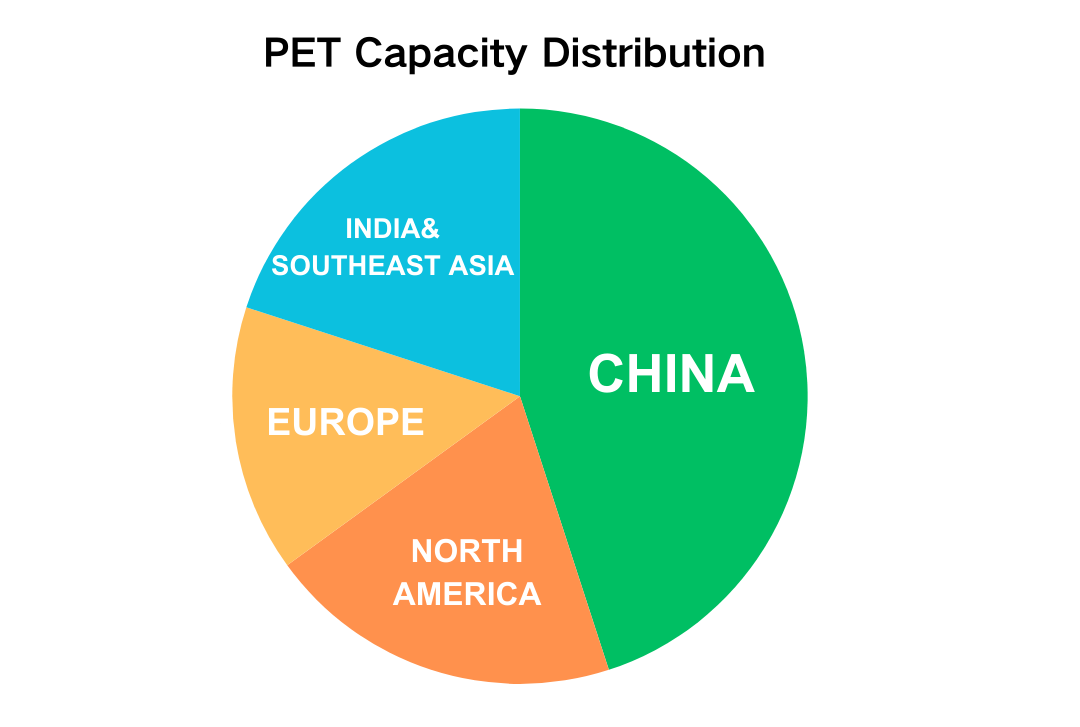

Global PET Resin Capacity Distribution Overview

China leads global PET production, accounting for over 40% of total capacity. The U.S. follows with about 15%-20% of global production, primarily concentrated in the South and Midwest. In Europe, Germany, Italy, and France contribute around 15%, focusing on high-end applications. Meanwhile, India’s capacity is growing rapidly, and Southeast Asian countries, such as Thailand and Vietnam, collectively hold approximately 10%-15% of the global market share.

For buyers, the future PET supply landscape is important to note. Over the next few years, 17 new PET projects are expected to come online, mainly in North America and the Middle East. China offers competitive pricing for polyester bottle chips, positioning itself as a major supplier. By 2028, China will remain the leader in global PET capacity expansion, with India and Saudi Arabia also becoming key production hubs.

Furthermore, with the increasing demand for renewable resources and eco-friendly materials, the recycling of PET and the development of bio-based PET will become key factors in procurement decisions. These trends are expected to drive the global PET industry towards more sustainable practices.

Recent Changes in PET Bottle Grade Market Capacity

The global PET industry is undergoing a shift, with supply adjustments affecting the bottle grade PET market as several manufacturers announce production cuts.

In China, key producers like Wankai New Materials and Billion Industry have adjusted planned capacity expansions, while production schedules at China Resources' plants have also been affected, leading to a reduction of approximately 15,000 tons per day in December.

In Europe, Alpek in the UK has halted a 150,000-ton plant due to force majeure, and maintenance at Germany’s Equipolymers and Spain’s Novapet may impact supply.

New production lines in Egypt (180,000 tons) and Turkey (300,000 tons) in the coming years are expected to influence the Middle Eastern and European markets, potentially challenging China’s export share. But these plants are likely to focus more on PET film production, limiting direct competition with the bottle grade PET resin chips market.

Despite some production cuts in China, the overall supply will not be significantly impacted due to the large base of PET resin production.Buyers should monitor capacity changes and market trends closely, adjusting procurement plans to manage supply chain disruptions, price volatility, and delivery delays.

Key Trends in PET Raw Material Prices

The polyester raw material market is currently facing multiple challenges, driven by factors such as fluctuations in crude oil prices, supply chain uncertainties, and weak demand.

Crude oil prices have been volatile, experiencing a downward trend as tensions in the Israel-Hezbollah conflict ease and supply expectations increase, putting pressure on the cost structure of the polyester supply chain.

As for ethylene glycol (EG), supply has been adjusted due to delays in U.S. cargo shipments and slower tender progress in Iran. Visible inventory is expected to gradually rise after mid-January 2024. Additionally, Sanjiang Petrochemical’s planned early maintenance in January will help ease supply pressure, which could drive EG prices higher.

For buyers, it's crucial to monitor changes in the supply chain and fluctuations in raw material prices, adjusting procurement strategies as needed to address the challenges of market uncertainty.

Global Dynamics Shaping the Future of PET Plastic Production

Global environmental policies are calling for restrictions on PET production. However, strong demand from industries such as electric vehicles and packaging is likely to continue driving PET capacity growth. While limiting petroleum-based products and plastic production is seen as a way to achieve sustainability goals, plastics remain essential, especially in lightweight and high-performance applications.

On November 24, 2024, plastic pollution treaty negotiations in Busan, South Korea, involving 175 countries, failed to reach a consensus. Oil-producing countries are more focused on waste management, while some environmental organizations push for production cuts to reduce plastic waste. This debate affects both global environmental protection and economic policies.

Meanwhile, global oil companies are heavily investing in petrochemical products, particularly plastics, as a strategy to address the anticipated decline in fossil fuel demand. Despite a weaker plastic market, petrochemicals play a crucial role in the green transition, particularly in electric vehicles' need for lightweight plastics. About 75% of emission reduction technologies rely on petroleum-derived chemicals.

In the United States, policy shifts are impacting global plastic production. The contrast between the Trump administration's market liberalization and the Biden administration's push for environmentally friendly alternatives signals that future U.S. policies will influence global plastic governance.

Overall, policy restrictions and technological innovations will shape the PET market's supply and demand dynamics.

Conclusion

The PET market is poised for significant expansion over the coming years, driven by ongoing industrial demand and advancements in product applications. As sectors like packaging and consumer goods continue to evolve, the market will likely see further innovations in sustainable solutions and efficient production processes, reinforcing PET’s role as a key material in modern industries.

REFERENCE